Small business needs are not only plenty but unexpected too. With so many business funding options flooding the online lending market, it is often confusing to choose the right lender that offers loans for small business.

We are a reliable business financing provider. With a strong and resourceful lending expertise, we have supported many small businesses through unsecured loans with bad credit. There are no tight lending standards. Transparent process, flexible loan terms, transparent process and fast turnaround-this is what we are all about.

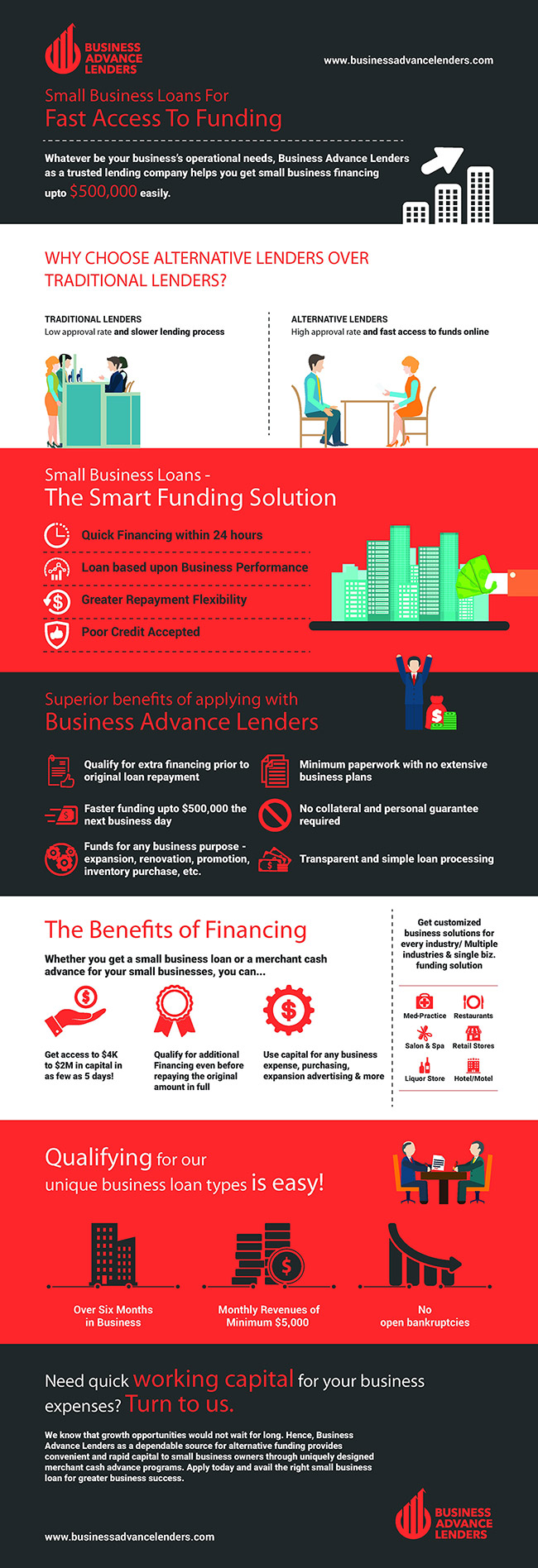

SMALL BUSINESS LOANS – THE SMART FUNDING SOLUTION

- Best way to avail quick financing within 24 hours of approval against future revenues

- Loan based on the overall business performance rather than credit score

- Greater repayment flexibility. Repay more when the sales are high and repay less when the sales are down

- Good credit is not mandatory to apply for unsecured business loans. Poor credit is also accepted.

SMALL BUSINESS LOANS FOR FAST ACCESS TO FUNDING

Whatever be your business’s operational needs, Business Advance Lenders as a trusted lending company helps you get small business financing up to $500,000. Why choose alternative lenders over traditional lenders? Traditional Lenders – Low approval rate and slower lending process.Traditional Lenders – Low approval rate and slower lending process.

Alternative Lenders – High approval rate and fast access to funds online.

Superior benefits of applying with Business Advance Lenders

- Qualify for extra financing prior to original loan repayment

- Faster funding up to $500,000 the next business day

- Funds for any business purpose- expansion, renovation, promotion, inventory purchase, equipment purchase, payroll, etc.

- Minimum paperwork with no extensive business plans

- No collateral and personal guarantee required

- Transparent and simple loan processing

Get customized business solutions for every industry OR Multiple industries and single business funding solution

- Restaurants

- Hotel Motel

- Salon and Spa

- Medical Practices

- Liquor Stores

- Retail Stores

- Dental Practices

Common eligibility criteria for different loan types OR Qualifying for our unique business loan types is easy!

- Over Six months in business

- Monthly revenues of minimum $5,000

- No open bankruptcies

Need quick working capital for your business expenses? Turn to us.

We know that growth opportunities would not wait for long. Hence, Business Advance Lenders as a dependable source for alternative funding provides convenient and rapid capital to small business owners through uniquely designed merchant cash advance programs. Apply today and avail the right small business loan for greater business success.